Quote (MildSambal @ 13 Aug 2024 22:12)

-go read fear and greed indexes since you seem oblivious to them

You mean this one?

https://edition.cnn.com/markets/fear-and-greedQuote

The Fear & Greed Index is a compilation of seven different indicators that measure some aspect of stock market behavior. They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. The index tracks how much these individual indicators deviate from their averages compared to how much they normally diverge.

Those are metrics measuring the drivers of the stock market, not metrics of differences in the levels of corporate greed between different markets.

Quote

-you think consumer bankruptcy has no impact on costs? debt doesn't just vanish at the snap of a finger. it gets passed onto borrowers (including businesses) to recuperate losses

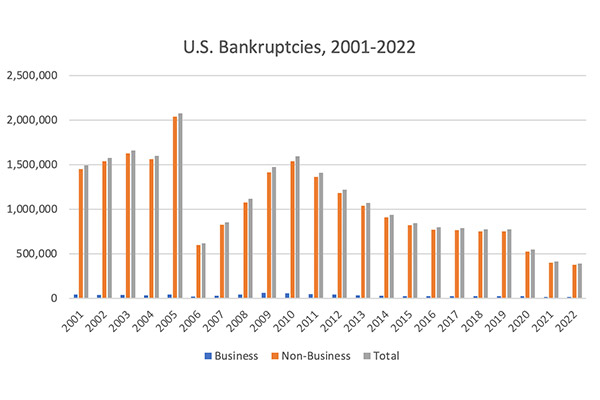

https://www.debt.org/bankruptcy/statistics/

Non-business bankruptcies were actually historically low in 2021 and 2022, when the big surge of inflation took place. This explanation seems plausible in theory, but is soundly rejected by empirical evidence.

Quote

-there are established differences in accounting and economic parameters between the US and EU, if you can't handle nuance and complexities then don't give ignorant opinions by simplifying Rs good Ds bad.

Those differences can maybe explain the 0.3% difference in inflation rates between the US and EU from June 24, but it surely can't explain the 2.4% difference from January 22.

And just for the record: even if inflation rates were identical in June 24, that would still be an awful performance for the US, considering the context, i.e. how much harder Europe was hit by the energy price shock from the Ukraine war.

Quote

-the US has been above the EU GDP per capita *checks notes* always? shocker that it would go on this year

What the hell does GDP/capita have to do with either inflation or percentage-based growth of absolute GDP? For example, from 2006 through 2008, the EU had higher GDP growth rates than the US although the US had the higher GDP/capita. During the 2010s, Germany has consistently had higher GDP/capita and

lower inflation rates than the eurozone at large.

None of the things you say make sense once one applies even just a modicum of scrutiny.

This post was edited by Black XistenZ on Aug 13 2024 02:56pm Guests cannot view or vote in polls. Please register or login.

Guests cannot view or vote in polls. Please register or login.